🎓 Parent’s Guide to California State Scholarships & Grants (2025–2026)

Last Updated on January 2, 2026California has real money on the table — but it’s a multi-step system. Filing the FAFSA (or CA Dream Act) is step one… but many families miss the money because a second step (like GPA submission or WebGrants actions) never gets completed.

Want to explore scholarships beyond state aid? Browse colleges on our College Scholarships hub, compare options using the CRP Scholarship Search Tool, or see other states on the State Scholarships & Grants hub.

- How California aid works

- Major programs (Cal Grant, MCS, CCPG, Chafee, Dream Act)

- Deadlines (simple table)

- How state aid interacts with college scholarships

- Who benefits most (reality check)

- Colleges that stack best

- FAQs

- ✅ Pro tip: Create (and save) your student’s WebGrants 4 Students login — that’s where most “missing money” gets fixed.

📌 What to do right now

- Step 1: Create FSA IDs for both parent and student at studentaid.gov/fsa-id

- Step 2: Submit the FAFSA (or CA Dream Act Application if eligible) as early as you can

- Step 3: Confirm your student’s Cal Grant GPA was submitted (many schools do it automatically — but don’t assume)

- Step 4: Log into WebGrants 4 Students to verify School of Attendance, outstanding tasks, and award status

⚡ 10-Second California Aid Explainer (plain English)

TL;DR: In California, you don’t just “fill out the FAFSA and wait.” Most state money follows a simple stack: FAFSA/CADAA → Cal Grant GPA submission → WebGrants follow-through.

- Step 1: You fill out the FAFSA (or CA Dream Act).

- Step 2: California (and your college) use that info to decide what state aid you qualify for (Cal Grant/MCS and/or a community college fee waiver).

- Step 3: Your college applies the money to your bill — but housing is usually still the biggest gap.

The two most common “money lost” mistakes: missing the Cal Grant GPA submission and not finishing tasks in WebGrants. If you only do one thing today: log into WebGrants and confirm “School of Attendance.”

How California State Aid Actually Works

California is a hybrid aid state: it has strong need-based support (Cal Grant, community college fee waivers, foster youth aid), plus broader support for middle-income families through the Middle Class Scholarship.

- Hybrid structure: Need-based grants + middle-income support (MCS).

- Two-step reality: It’s FAFSA/CADAA + GPA submission + WebGrants follow-through (exact GPA timing can vary slightly by year or school).

- Residency matters: Generally for California residents or AB 540-eligible students.

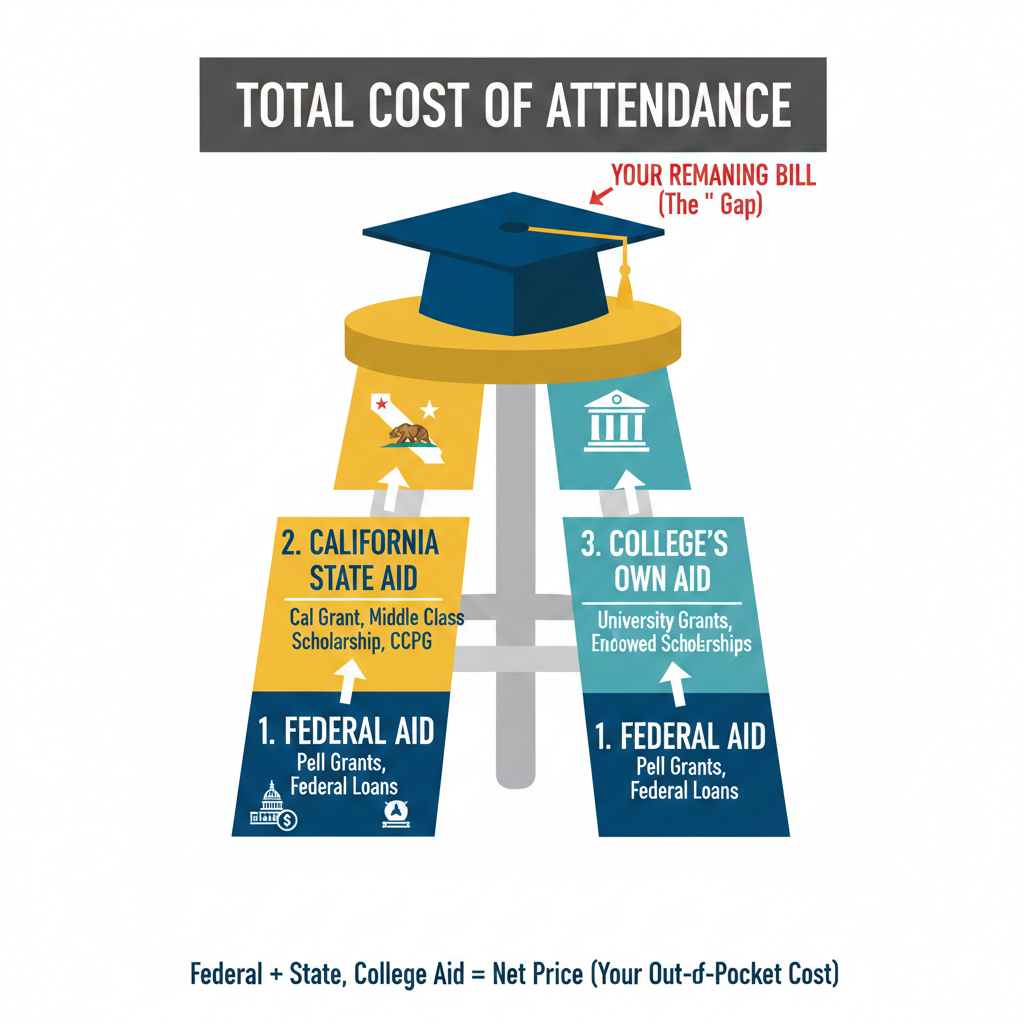

The “Aid Layers” (why you might still have a bill)

The Net Price Formula (plain English)

Net Price = Cost of Attendance − (Grants + Scholarships)

This is the amount your family covers through savings, payment plans, work, or loans.

Cal Grant is changing (which is why the rules feel confusing): California has updated Cal Grant rules to reduce barriers (especially for students starting at community colleges), but you may still see Cal Grant A / B / C labels in portals and award letters. Best practice: follow the steps below, then confirm the current-year rules on the CSAC site.

WebGrants Status Cheat Sheet (what it usually means)

- Pending: CSAC is waiting on something (often GPA submission, school-of-attendance confirmation, or other required info)

- Awarded: You’ve got it — next step is making sure your college portal reflects it when they package aid

- Incomplete / To-Do: There’s an action required in the account (school change, certification, verification)

- Ineligible: Usually income/asset ceiling, eligibility rule, enrollment status, or missing requirement — if you think it’s wrong, look for an appeal option or ask your college financial aid office

Quick GPA Submission Check (the #1 Cal Grant failure point)

- Ask the counselor: “Was my student’s Cal Grant GPA submitted to CSAC?”

- In WebGrants, look for a status line that indicates GPA received (or a missing GPA task)

- If your student changed schools (or did homeschool/online), GPA submission can slip — double-check early

⚠️ The “transfer / community college” trap:

If your student starts at a California Community College, some Cal Grant awards may be held in reserve until they transfer to a tuition-charging CSU/UC

(for example, Cal Grant A is commonly held in reserve at a CCC for up to about two years).

What to do: Keep your school of attendance updated in WebGrants — and update it again when you choose your CSU/UC so the Cal Grant follows you.

Major California Programs (Top 2–5)

These are the programs that move the needle for most families. (This is orientation — not an exhaustive list.) If you do nothing else, focus on FAFSA/CADAA + Cal Grant GPA + WebGrants.

Quick reality check: UC vs CSU vs Community College

| System | Primary State Aid | What It Typically Covers |

|---|---|---|

| Community College (CCC) | CCPG (fee waiver) + some Cal Grant pathways | Enrollment fees waived (often) + possible access/living support depending on eligibility |

| CSU | Cal Grant / MCS | Often targets systemwide tuition (housing usually still a gap) |

| UC | Cal Grant / MCS | Often targets systemwide tuition (housing usually still a gap) |

Note: Actual awards vary by income/assets, enrollment, cost of attendance, and other aid. Think “typical outcome,” not a guaranteed bill.

Cal Grant (A / B / C pathways)

- Who it’s for: California residents (and some Dream Act-eligible students) with financial need + eligibility criteria

- Typical outcome: Often covers systemwide tuition at CSU/UC; may provide an access/living allowance in some cases

- Deadline snapshot: FAFSA/CADAA + GPA submission by the state priority deadline (see table below)

- Gotcha: “FAFSA done” is not enough if GPA is missing

Middle Class Scholarship (MCS)

- Who it’s for: UC/CSU undergrads (and some credential students) with remaining need after other aid (some students also have Cal Grants)

- Typical outcome: Gap-filler that can be meaningful, but varies widely

- Deadline snapshot: FAFSA or CADAA by the state priority deadline

- Gotcha: Often appears later in the year — don’t panic if it isn’t on the first award letter

California College Promise Grant (CCPG)

- Who it’s for: Community college students with financial need (or who meet local criteria)

- Typical outcome: Waives community college enrollment fees (does not usually cover books/housing)

- Deadline snapshot: Often rolling — usually triggered through FAFSA/CADAA or a CCPG form via your community college/CCCApply

- Gotcha: Even with CCPG, other costs (transportation, books) can still hit hard

Chafee Grant (Foster Youth)

- Who it’s for: Eligible current/former foster youth

- Typical outcome: Can provide extra money on top of other aid (not just tuition)

- Deadline snapshot: FAFSA/CADAA + separate Chafee steps

- Gotcha: Requires a separate application/verification — not automatic

CA Dream Act (CADAA) + DSIG

- Who it’s for: Eligible students who cannot file FAFSA

- Typical outcome: Access to many California state programs (including Cal Grant/MCS, if eligible)

- Deadline snapshot: CADAA by the state priority deadline

- Gotcha: Still needs follow-through (GPA submission / WebGrants tasks may apply)

Want to compare scholarships across colleges?

Use the CRP Scholarship Search Tool to filter and compare awards quickly.

Deadlines (Simple Table)

Save or print this table — then verify the current-year dates on CSAC before you file. California deadlines can shift by year (especially after FAFSA changes), but this gives you the structure.

Mobile tip: If you’re on a phone, you may need to scroll right to see all columns.

| Program | Application Deadline | Document Deadline | Where to Apply |

|---|---|---|---|

| Cal Grant (main consideration) |

State priority deadline (For 2025–2026, CA extended to Apr 2, 2025.) |

GPA submission Often tied to the same priority window; confirm with school/CSAC |

csac.ca.gov + WebGrants |

| Middle Class Scholarship (MCS) |

State priority deadline (For 2025–2026: Apr 2, 2025) |

No separate docs usually required (but verify if selected for verification) |

FAFSA/CADAA + CSAC MCS page |

| Community College Cal Grant consideration |

Sep 2, 2025 (additional CCC consideration window) |

As required (varies by pathway) |

FAFSA/CADAA + Cal Grant info |

| California College Promise Grant (CCPG) | Rolling (varies by college) | Rolling (varies by college) | Your community college financial aid office |

| Chafee Grant |

FAFSA/CADAA by priority deadline (recommended) plus Chafee application timing |

Verification as required | chafee.csac.ca.gov |

Important: California’s priority date has historically been early March, but 2025–2026 included an extension. Always confirm the current cycle on CSAC.

How California Aid Interacts With Colleges (Why You Still See a Bill)

California state aid is powerful — but it usually targets tuition / fees first. The biggest gap for most families is still housing + meals, and that’s where colleges’ own grants and scholarships matter.

- Cal Grant and MCS can reduce tuition significantly at CSU/UC — but they rarely “finish the job” alone.

- Campus grants (UC/CSU and private colleges) often determine whether your net cost is manageable.

- Cost of Attendance cap: If total aid exceeds the school’s official COA, the college will adjust something down.

Real-world example: Two students can have the same Cal Grant, but very different final bills because campus aid differs. That’s why you should compare net price — not just sticker price — when choosing between UC/CSU/private options.

Going Out-of-State?

Families in California may qualify for reduced tuition through the

Western Undergraduate Exchange (WUE).

This can be a smart backup plan if in-state options don’t work financially.

Who Benefits Most (Reality Check)

Low-income families

Often benefit the most because Pell + Cal Grant + campus grants can stack. The biggest risk is not income — it’s missing steps (GPA submission, WebGrants tasks, verification).

Middle-income families

This is where the Middle Class Scholarship can matter, especially at UC/CSU. But the award varies and may show up later — so don’t self-disqualify if your income “sounds too high.”

High-achieving students

In California, strong students often win the biggest savings through institutional scholarships (campus awards), especially at private colleges — not through extra state merit programs.

First-gen families

Same eligibility — higher risk of missed follow-through. A simple system helps: FAFSA/CADAA + GPA check + WebGrants login + college portal review.

💡 Income change since your tax return?

If WebGrants (or your award letter) shows “ineligible” due to income, but your family’s financial situation has changed significantly (job loss, medical bills, etc.),

ask your college about a Professional Judgment appeal. Colleges can sometimes re-evaluate your FAFSA data and adjust eligibility for aid.

Colleges That Stack Best With California Aid

State aid works best when it stacks with strong institutional aid. Below are examples in two buckets: public stacking (UC/CSU) and private stacking (Cal Grant + large institutional grants).

These are examples based on common aid outcomes — not an official ranking or guarantee.

Public stacking (UC / CSU)

Private stacking (Cal Grant + institutional aid)

Tip: Confirm your California programs here, then open each college’s scholarship page to see what the university adds. You can also compare schools side-by-side using the CRP Scholarship Search Tool.

California State Aid FAQs

Does California state aid cover housing?

Sometimes it helps, but usually tuition/enrollment fees are the main target. Housing is often still the largest “gap,” which is why institutional aid matters so much.

Do we need to do anything beyond the FAFSA?

Often yes. For Cal Grant consideration, many students need FAFSA/CADAA + GPA submission. Then, WebGrants is where you confirm “school of attendance” and fix missing steps.

What if my student starts at a community college and transfers?

This is common in California — and it can be smart financially. The key is making sure any Cal Grant-related steps stay current in WebGrants (school updates, certifications if required), so eligibility doesn’t get stuck in the wrong status.

What if our income changed since we filed taxes?

If your financial situation changed significantly (job loss, reduced hours, medical bills, etc.), ask your college about a Professional Judgment (sometimes called an “income appeal”). Colleges can sometimes adjust FAFSA data and re-evaluate eligibility for aid.

Does California aid stack with scholarships?

Yes, it can stack with federal aid and college scholarships — but total aid can’t exceed the school’s Cost of Attendance. If your aid goes over the cap, the college will adjust something down.

If you’re stuck, your college financial aid office (and CSAC support) can help resolve California-specific issues like missing GPAs, school-of-attendance updates, and verification steps.

Looking beyond California? Visit the State Scholarships & Grants hub to explore aid programs in all 50 states.