🎯 What College Really Costs: A Parent’s Guide to Net Price & SAI (Formerly EFC)

You’ve probably seen the $30,000+ sticker price and thought, “There’s no way we’re paying that.” Good news: you’re right. But the bad news? Figuring out what you will pay is a mess. This guide cuts through the confusion — no financial aid jargon, just real numbers and straight talk.

I remember staring at our daughter’s ACT score and thinking, “We’ve got this.” But the offers didn’t match the dream. This page is what I wish someone had handed me before we built the college list — and before the financial gut punch landed.

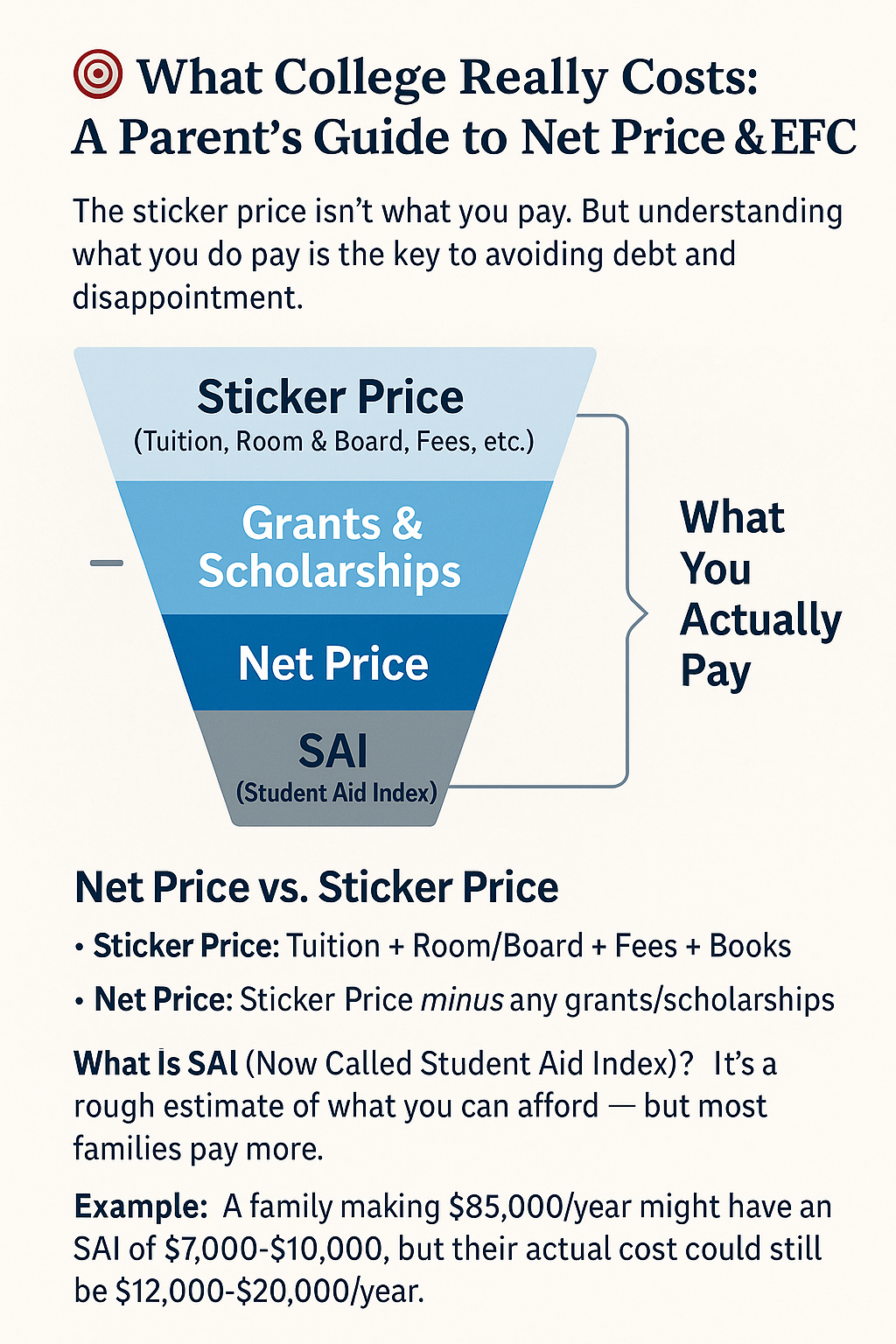

✅ Net Price vs. Sticker Price

- Sticker Price: Tuition + Housing + Fees + Books

- Net Price: Sticker Price – Grants & Scholarships

- SAI (Student Aid Index): What colleges think you can afford (based on FAFSA or CSS)

- NPC (Net Price Calculator): Tool each college provides to estimate your cost

Bottom line: The Net Price is your real budget target.

It’s like buying a car — no one pays MSRP, but colleges don’t exactly hand you a final price either.

💸 What Is SAI (Student Aid Index) — and Why It Matters

SAI is just a formula result based on your FAFSA or CSS Profile. It’s a number colleges use to decide how much need-based aid your kid qualifies for. Not a bill. Not a promise. Just a score that drives the aid formula behind the scenes.

Example: If your SAI is $9,000 and the college’s total cost is $30,000, the most need-based aid they might offer is $21,000 — if they meet full need. Most don’t.

When our SAI came back at $9,000, I actually felt a little relieved… until I realized our net cost was still pushing $20K. That moment changed everything about how I approached college planning.

🧮 How Is It Calculated?

- Parent income (AGI)

- Parent assets (excluding retirement)

- Student income and assets

- Household size

- Number of kids in college

CSS Profile schools may also consider home equity, business value, and noncustodial parent income.

📊 Compare These 3 Real Families

| Family | Income | SAI | Merit Aid | Need Aid | Final Net Price |

|---|---|---|---|---|---|

| Smiths | $55,000 | $2,000 | $5,000 | $15,000 | $8,000 |

| Johnsons | $85,000 | $9,000 | $12,000 | $5,000 | $13,000 |

| Changs | $125,000 | $19,000 | $18,000 | $0 | $16,000 |

Colleges use your SAI to limit need-based aid. A high SAI means less help — and more cost passed on to you. They aren’t being cruel. They’re budgeting. But you need a smart plan to fill the gap.

🧠 Common Myths That Hurt Families

| Myth | Reality |

|---|---|

| “FAFSA is only for poor families.” | False — it’s often required for merit aid too (like MESG in Mississippi). |

| “We make too much to get anything.” | You might still qualify for merit or state grants — even at $85K+. |

| “Private schools are more expensive.” | They often offer more aid than publics if your kid’s profile fits. |

| “My kid has a 30 ACT — that’s a free ride.” | Not in most cases. Test scores often matter more than GPA — but even a 30 ACT isn’t enough alone. |

| “We’ll figure it out after she gets in.” | Waiting = missed deadlines and lost aid. Start early. |

📘 Real Example: Net Price Breakdown

These are the real numbers we got from Net Price Calculators and scholarship charts — not guesses.

Mississippi State University

Sticker Price: $26,000

Merit Aid: –$12,000

State Aid (MTAG + MESG): –$3,500

Net Price: $10,500/year

University of Alabama

Sticker Price: $34,000

Merit Aid (UA Scholar): –$24,000

Net Price: $10,000/year

Note: These are Fall 2025 estimates. Run your own NPCs based on your family’s info.

🧭 Quick Steps to Estimate Your Net Price

- Write down your Adjusted Gross Income (AGI)

- Add any college savings or assets (if needed)

- Visit each college’s Net Price Calculator

- Input your kid’s GPA, ACT/SAT, and income info

- Subtract grants/scholarships = your net price

📥 Download the Net Price Tracking Sheet (PDF)

🎯 Use the U.S. Department of Education’s Net Price Calculator Finder to look up NPCs by school.

➕ College Scholarship Database

📝 Brag Sheet Builder

📄 Aid Offer Comparison Guide

❓ Common Questions About SAI (Student Aid Index)

What is the difference between SAI and EFC?

SAI is the updated name for what used to be called EFC. The formula is mostly the same — just rebranded to avoid confusion over the word “contribution.”

Is SAI the same as what we have to pay for college?

Nope. It’s just a number colleges use behind the scenes to calculate aid — not your final bill.

What is a good SAI number?

Lower is better. Under $6,000 may unlock Pell Grants. Over $15,000? You’ll probably need merit aid to make it affordable.

Does owning a home affect SAI?

Only if the school uses the CSS Profile. FAFSA doesn’t count home equity. Some private schools do.

How can I lower my SAI?

Things that help: two kids in college, moving assets out of your kid’s name, contributing to retirement. But don’t make big moves without checking the impact.

Can a high SAI be offset with merit aid?

Yes — and it often needs to be. Some schools will offer $10K+ just for strong test scores, even if your SAI is too high for need-based help.

How do colleges use my SAI to decide how much aid we get?

Colleges use your SAI to cap how much need-based aid you qualify for. But most don’t meet that need — they give less, and leave you to make up the gap.